October 2023

October, 15th.

A lot is happening in the financial world right now, so let’s dive in and review some key events and trends.

Starting with the economy, some notable developments were on the inflation front. The producer price index in the US rose 0.5% in September, showing that inflation is still elevated at the wholesale level. The consumer price index also edged up 0.4%, with the main drivers being higher shelter and gas costs. Core CPI, which excludes food and energy, was up 0.3%. At the Fed’s September meeting, officials indicated inflation has moderated from peak levels, but they need more evidence it is declining towards their 2% target. Overall, the data confirms inflation remains sticky, and the Fed will likely maintain a restrictive policy for now.

Shifting to stock market performance, it was a mixed week on Wall Street. The Dow and S&P 500 posted modest gains, while the tech-heavy Nasdaq declined slightly. Defense and financial stocks were among the outperformers, with Northrop Grumman, Leonardo DRS, and major banks like JPMorgan, Wells Fargo, and Citi seeing nice bumps. Airlines pulled back amid suspended flights to Israel during the conflict there. Stocks saw increased volatility as Treasury yields whipsawed after the hotter-than-expected inflation data.

Looking ahead to next week, there are some key events on the calendar:

Major companies like Johnson & Johnson, Goldman Sachs, Netflix, and Tesla will report earnings on Tuesday. Tesla’s call on Wednesday will be especially closely watched. Investors will also be tuning in to speeches by Fed officials, including Chairman Powell, on Thursday for any signals on the interest rate outlook.

On the data front, September retail sales will provide insight into the consumer economy. And in Europe, the ECB rate decision on Thursday will be a focal point, with expectations they will hike by 75 basis points.

In Asia, China’s Q3 GDP numbers on Monday will draw attention as markets look for signs of improvement after a weak first half. Any new supportive policy measures could also emerge.

It’s shaping up to be an eventful week. Earnings season is kicking into high gear, central banks are firmly in focus, and geopolitical tensions remain elevated. There are still many uncertainties, but we’ll be here to break down the key developments as they unfold.

September 2023

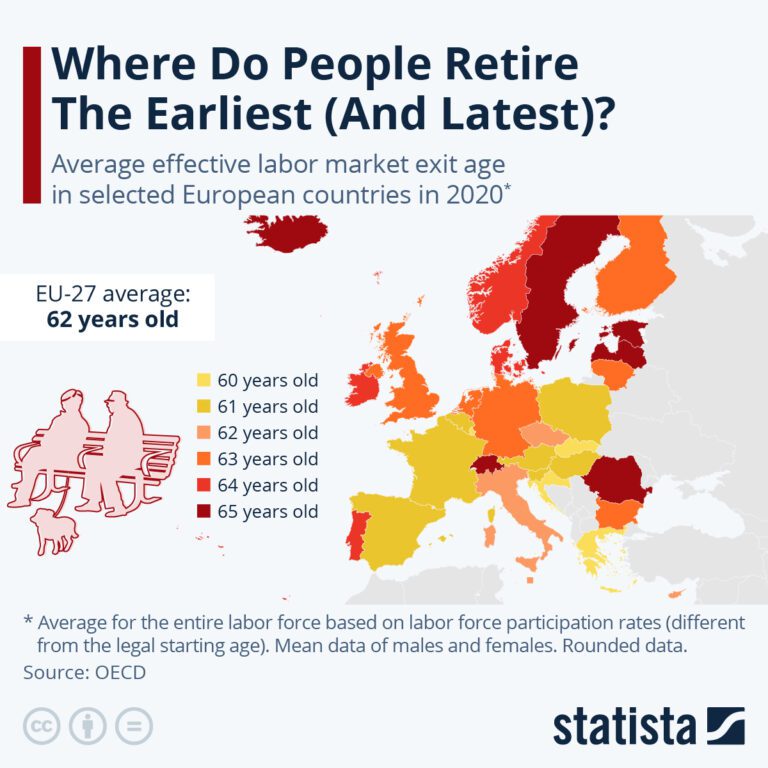

Discover the European Countries Where People Retire Years Before You

Across Europe, the official retirement age is rising. Most countries have set the full pension age around 65 or older. But data shows Europeans are still exiting the workforce well before their golden years officially start, according to Statistica.

The Organization for Economic Cooperation and Development (OECD) tracks the average effective age at which people stop working. This labor market exit age reveals retirement realities beyond statutory pension ages.

According to the OECD, Sweden, Iceland, Switzerland, Latvia, Estonia, and Romania top the list for older retirement. Workers average around 65 before retiring.

By contrast, countries like Luxembourg, Slovakia, Croatia, and Greece see earlier retirements around age 60. Other nations with comparatively young retirement ages include France, Belgium, Spain, and Austria at 61.

The average retirement age across the 27 member states of the European Union is 62. This is approximately three years younger than the legal retirement age of 65, common among most EU countries.

Clearly, many Europeans find ways to begin their golden years before the official pension age kicks in. Some switch to part-time roles as they approach traditional retirement milestones. Others have enough savings to leave the rat race early. Moreover, pension incentives in some countries provide an earlier escape hatch.

This trend towards early retirement prevails despite policy efforts to curb ballooning public pension costs by raising the full benefits age. While not yet a crisis, the gap between actual and legal retirement age is poised to grow as populations age.

The outcome is a complex calculus for governments balancing pension solvency, personal choice, and prolonged careers. Meanwhile, Europeans work to achieve flexible transitions into retirement on their own terms.

Are Retirees Spending More Than They Can Afford?

A survey of Annuity.org was performed in August through October 2022. The survey asked 300 participants about their personal finance habits and goals. The survey found that 27% of retirees said their spending amounts were higher than what they could afford. The survey also revealed the most common financial priorities and challenges for retirees.

Here is an outline of some tips as proposed by BankingRates:

Cost-cutting area 1: Dining out

- Restaurant meals are a luxury and should be among the first items to go

- Prepared meals at grocery stores are cheaper alternatives

Cost-cutting area 2: Medical care

- Review Medicare plan options to lower costs

- Seek free health insurance counseling from SHIPs

Cost-cutting area 3: Traveling

- Avoid overnight trips that require hotel stays

- Take day trips or staycations close to home

Travel off-season or during the week to save on lodging and air fare5

Cost-cutting area 4: Car ownership

- Most retired couples can get by with a single car.

- Eliminate a second car payment and related expenses.

Cost-cutting area 5: High-interest debt

- Pay off credit card balances and loans as soon as possible

- High-interest debt is a burden on the budget and increases interest payments

Conclusion:

Retirement is a phase of life that should be enjoyed to the fullest, but that doesn’t mean you should spend more than you can afford. Reducing certain expenses can help you live within your budget and enjoy your golden years without financial worries.

By making small changes like dining out less, traveling off-season, and paying off high-interest debt, you can have more money to spend on the things that truly matter. So why not take control of your finances and make the most of your retirement? With a little bit of effort and planning, you can live your best life without breaking the bank.

Live Your Golden Years Abroad on a Budget

Are you dreaming of retiring overseas but worried about costs? Exotic destinations like Southeast Asia and Latin America offer an affordable retirement haven.

From the U.S. News, we could compile for you a list of the top 10 cheapest places to retire abroad in 2023. These overlooked gems deliver a high quality of life for a fraction of what you’d pay in the U.S.

Topping the list is Chitré, Panama. This up-and-coming city on Panama’s Azuero Peninsula provides easy access to beaches and outdoor activities. The low cost of living and real estate leaves ample room in your retirement budget.

Nearby Belize is home to Corozal, the second most affordable overseas retirement spot. English is widely spoken in this coastal town, and the culture is a laidback mix of Caribbean and Mexican influences.

Speaking of Mexico, the Riviera Maya along the Yucatan Peninsula offers stunning beaches and ancient Mayan ruins at bargain prices. Places like Playa del Carmen and Tulum score points for an enjoyable retirement lifestyle.

Time to highlight Southeast Asia’s affordability too. Pattaya, Thailand, and George Town, Malaysia, both deliver modern amenities and Old World charm on a shoestring.

Spain and Italy both contain hidden retirement havens devoid of big city prices. Check out Sanlúcar de Barrameda, Spain, for its medieval castle and sherry wine region. Or escape to Popoli, Italy, where your nest egg will stretch thanks to small-town living.

Other notable locales include Da Lat, Vietnam, praised for its cool climate and French colonial architecture. Medellín, Colombia, offers urban amenities alongside flower-filled villages. And Lisbon, Portugal’s capital city, rewards retirees with mouthwatering cuisine and postcard-worthy scenery.

While these destinations promise an affordable retirement, it’s smart to visit first before making a permanent move overseas. But for adventurous retirees, the chance to write a new chapter abroad awaits.

Inflation Erodes Retirement Dreams for Many Americans

The golden years need to look more straw for a growing number of Americans approaching retirement age. A sobering new survey by Natixis Investment Managers (April 2022) paints a concerning picture of retirement insecurity in the face of high inflation and volatile markets.

Natixis’ annual Global Retirement Index ranked the retirement security of 44 countries based on factors like finances, health, and quality of life. While the United States improved its score slightly from last year, it still slipped two spots to No. 20 among developed nations. Clearly, there is room for improvement regarding Americans’ retirement outlook.

The survey results highlight a contrast between optimism and pessimism among future retirees. Some envision a comfortable retirement with financial freedom to pursue their dreams. But others see trade-offs ahead, such as downsizing their lifestyle, delaying retirement, or relying on family or friends if savings run short.

With inflation recently hitting a 40-year high, it’s understandable that nerves are fraying for those approaching their golden years. Rising prices take a direct bite out of fixed incomes. And market volatility adds uncertainty around nest eggs earmarked for retirement.

While inflation is likely a temporary blip, its impact serves as a wake-up call. Retirement planning must account for unexpected costs. Increased savings, delaying Social Security benefits, annuitizing income, and working with a financial advisor could help strengthen retirement security.

With prudent planning, dreams of a fulfilling and financially stable retirement can still come true. But it takes preparation, adaptability, and expert guidance to navigate today’s economic crosscurrents. The time to plan for tomorrow is now.

80 is the New 60: Changing Perceptions of Aging Among Seniors

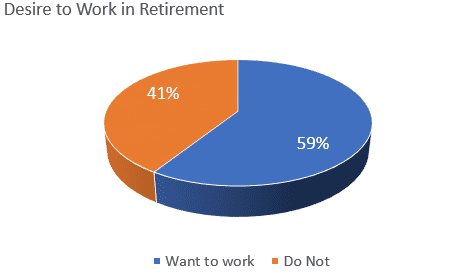

According to a Harris Poll study (June, 2023) conducted by Age Wave, 66% of respondents aged 50 and older view retirement as a new chapter in life, compared to 16% who see it primarily as a time for rest. Furthermore, 59% of pre-retirees and retirees reported wanting to work in some form during their retirement.

The study also found that 69% of these respondents prefer “longevity” when considering growing older, compared to 31% prefer “aging.” This preference may be related to the view of “active” retirements.

Interestingly, those surveyed who were at least 65 also reported feeling freer, happier, and less anxious compared to younger demographics.

Respondents aged 50 and older appear to view their relative youth differently than their predecessors. They stated that while age 60 was considered “old” during their grandparents’ time, age 80 is now the marker of being “old.”

This survey proves that the traditional view of retirement as a time to step away from work and relax might no longer hold.

The responses suggest that retirement planning for today’s retirees could look different than it did in the past (e.g., planning for “semi-retirement” rather than a clean break from work) and that prospects and clients might be more receptive to talking about “longevity” rather than “aging” during these retirement planning conversations.

How Today’s Retirees Stay Engaged Through Newfound Free Time

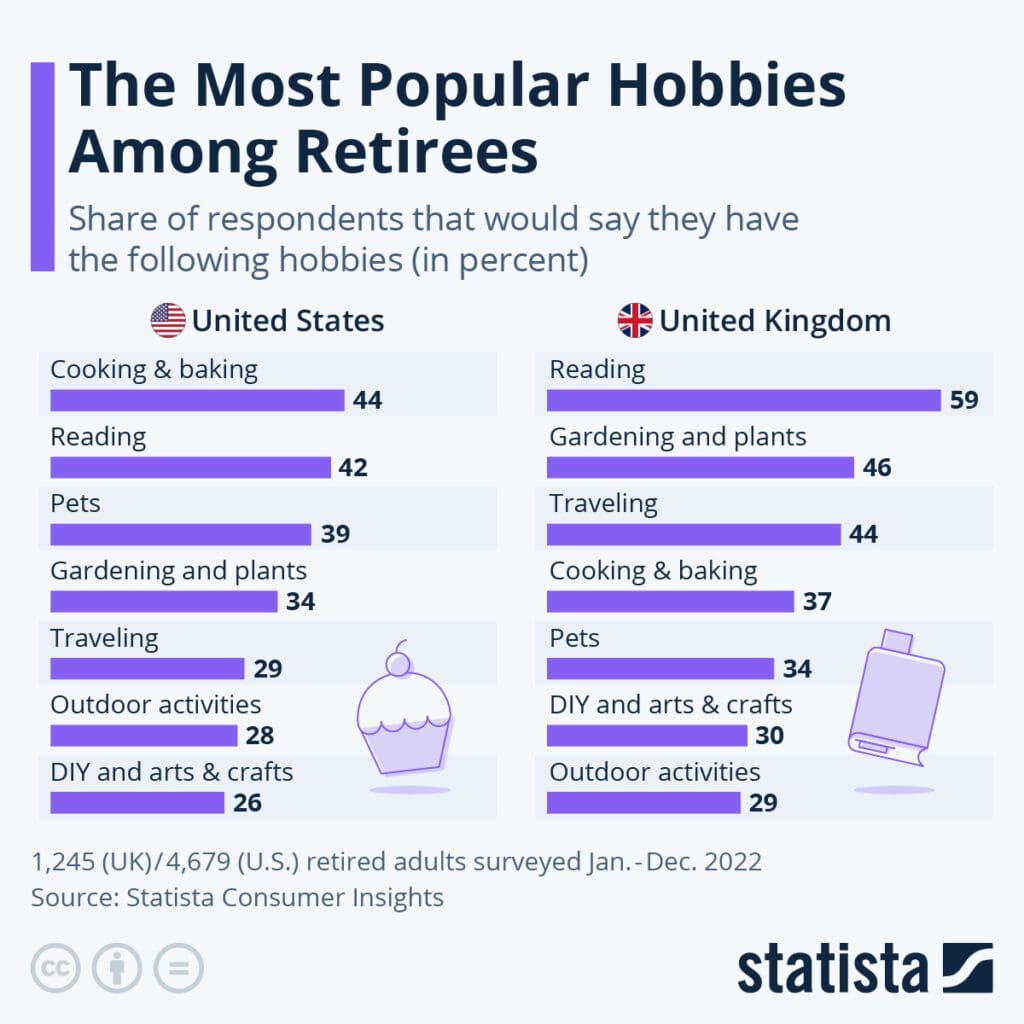

For today’s retirees, this new phase of life represents an open canvas. No longer bound to rigid schedules, they have time to cultivate new passions and embrace treasured pastimes. Recent surveys reveal the most popular hobbies giving purpose to retirees’ days.

In the United States, cooking and baking tops the list, according to a Statista survey. Nearly half of respondents said time in the kitchen absorbed their extra hours. This reflects a growing pursuit of pleasure, creativity, and healthier homemade foods.

Reading follows close behind as a favorite American retiree hobby, providing an affordable escape. Caring for pets and gardening/planting also allow retirees to find fulfillment through nurturing new life. Furthermore, interests like photography and crafts enable self-expression.

Outdoor activities resonate with around 30 percent of U.S. retirees. From golfing and hiking to bicycling and kayaking, fresh air and exercise rejuvenate life’s second act. Surprisingly, nearly 20 percent also enjoy video gaming, proving fun transcends generations.

Across the pond, reading again claims the top hobby spot for British retirees, according to Statista’s research. Escaping into literature and learning occupies free time for over half of respondents.

Gardening also captivates nearly half of British retirees. Meanwhile, travel entices retirees who spent years postponing bucket list adventures. Museums, concerts, restaurants, and shows offer local culture on demand.

Social circles energize a quarter of British retirees, higher than the 18 percent of Americans. Regular meetups, clubs, and events weave the community into post-career lives.

While many embrace their newfound free time alone or with family, hobbies engage mental and physical abilities. Volunteering, arts, sports, and games provide cognitive stimulation while combating isolation.