Instilling Financial Independence and FIRE Principles in Your Children

The path to financial independence and retiring early (FIRE) isn’t just about personal growth—it’s about family growth, too. Learn how to teach your children about money in the FIRE lifestyle.

In the world of personal finance, the FIRE (Financial Independence Retire Early) movement has been gaining significant traction. It’s a lifestyle that promotes financial independence and early retirement through disciplined savings, strategic investments, and frugal living. But how do we pass these principles on to our children? Let’s explore.

The Paramount Importance of Financial Education

Financial literacy, often overlooked in traditional education systems, is a critical life skill that lays the foundation for a secure and prosperous future. It’s a subject that rarely finds its way into school curriculums, leaving a significant gap in our children’s understanding of the world. This lack of financial education often results in ill-equipped adults to handle their finances, leading to debt, financial stress, and a lack of savings for retirement.

As parents, we have a golden opportunity and responsibility to fill this educational void. We must ensure our children understand the intricacies of money management, the power of savings, and the potential of smart investments. This knowledge is not just about making them money-wise; it’s about empowering them to take control of their financial destiny.

Introducing them to the principles of FIRE (Financial Independence Retire Early) can be a game-changer. The FIRE movement is not just about retiring early; it’s about achieving financial independence and freedom. It’s about making strategic financial decisions and living a disciplined lifestyle, prioritizing long-term financial health over short-term materialistic desires.

By teaching our children about FIRE, we’re not just giving them a lesson in finance; we’re instilling a mindset of financial resilience and independence. We’re teaching them to value their hard-earned money, to understand the difference between desires and needs, and to see the potential in every dollar saved or invested.

Moreover, we’re equipping them with the tools they need to navigate the often complex world of personal finance. They’ll learn how to budget effectively, how to save diligently, and how to invest wisely. They’ll understand the power of compound interest, the importance of diversification, and the value of patience in the investment journey.

In a world increasingly defined by economic uncertainties, teaching our children about FIRE can give them a sense of security and control. They’ll learn that they have the power to shape their financial future and that they don’t have to be at the mercy of debt or live paycheck to paycheck.

In essence, by educating our children about money and the principles of the FIRE lifestyle, we’re not just preparing them for a financially secure future—we’re empowering them to build a life of financial independence and freedom. And there’s no greater gift we can give our children than that.

Introducing Financial Independence (FIRE) to Your Children

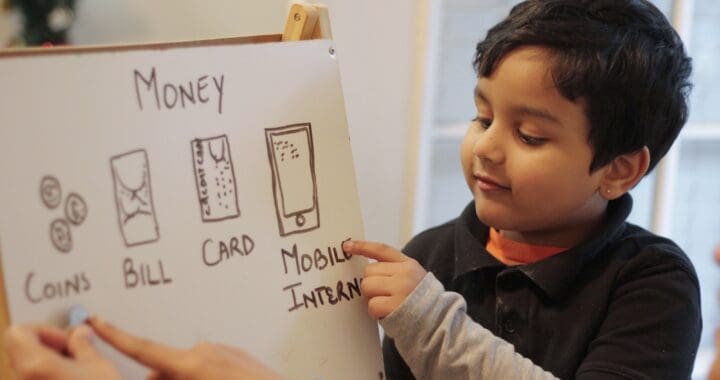

1. Start Early: The earlier children understand the value of money, the better. Use everyday situations like grocery shopping or planning a family vacation to teach them about budgeting and the cost of living.

2. Make it Fun: Use games and apps that teach financial concepts. Monopoly, The Game of Life, or online resources like Rich Kid Smart Kid can make learning about money engaging and enjoyable.

3. Show Real-World Examples: Share stories of individuals who have successfully followed the FIRE lifestyle. Websites like MrMoneyMustache or Mad Fientist offer plenty of real-life examples.

Teach Them About Saving

Teach your children the concept of “paying themselves first.” This means setting aside a portion of their allowance or earnings before spending anything else. Encourage them to save for their goals, whether a new toy, a trip, or a college fund.

Introduce Investing

Once they grasp the concept of saving, introduce them to investing. Explain how their money can grow over time through compound interest. Use simple examples to illustrate this concept. For instance, if they invest $100 with a 10% annual return, they’ll have $110 at the end of the year. If they leave that money invested, they’ll earn $11 the following year, not just $10.

Encourage Entrepreneurship

Encouraging entrepreneurship in children can be a game-changer, not just for their financial education but also for their personal growth. Starting a small business, such as a lemonade stand or a lawn mowing service, can teach them valuable lessons about the value of hard work, customer service, and the rewards of taking calculated risks.

Moreover, entrepreneurship can help children develop a growth mindset, where they learn to embrace challenges, persist through setbacks, and view failures as opportunities to learn and improve. It can also foster creativity and innovation as they come up with unique solutions to problems and create products or services that meet the needs and wants of their target audience.

As parents, we can support our children’s entrepreneurial endeavors by providing guidance, resources, and encouragement. We can help them identify their strengths, interests, and passions and guide them in selecting a business idea that aligns with their skills and values. We can also teach them the basics of business planning, such as market research, pricing strategies, and budgeting.

However, it’s essential to balance supporting and guiding our children and allowing them to own their businesses. We should encourage them to make decisions, take risks, and learn from their mistakes while providing a safety net and support system to help them navigate challenges and setbacks.

Encouraging entrepreneurship in children is not just about teaching them about money and business—it’s about fostering a growth mindset, nurturing creativity and innovation, and empowering them to take ownership of their lives and future. By supporting and guiding our children in their entrepreneurial endeavors, we can help them develop valuable life skills that will help and serve them well in all aspects of their lives.

Lead by Example

Children often learn more from what they see than what they’re told. Demonstrate the principles of FIRE in your own life. Try to show them your budget, discuss your savings goals, and involve them in financial decisions. This transparency can have a significant impact on their understanding of money.

The Benefits of Teaching Financial Independence (FIRE) Principles

By teaching your children about FIRE and financial independence you can surely prepare them for a successful financial future. They’ll learn to make smart money decisions, understand the value of saving and investing, and possibly even retire early.

Conclusion

Teaching your children about money in the FIRE lifestyle is an invaluable gift. It’s not just about preparing them for the future but empowering them to shape their own. So start today and set your children on the path to financial independence.

Remember, the goal isn’t to make your children money-obsessed but to equip them with the knowledge and practical tools they need to make informed financial decisions. As you guide them