Investment Apps and Platforms, Your Way to Financial Independence

The journey to financial independence and retiring early (FIRE) requires maximizing your savings and investments. To retire in your 30s or 40s, you must rapidly grow your portfolio during your peak earning years, and investment platforms are a good tool for that.

Choosing suitable investment platforms is vital to building wealth on the fast track. The best apps and services for FIRE enthusiasts offer low fees, customized portfolios, and hands-off automation.

This guide explores the top investment platforms to consider in your quest for financial freedom.

Best Investment Apps for Hands-On Traders

Investment platforms play a crucial role in achieving financial independence and retiring early (FIRE). Investors who aim to retire in their 30s or 40s need to maximize their savings and investments during their peak earning years. This requires choosing the right investment platforms that offer low fees, customized portfolios, and hands-off automation.

For DIY investors who enjoy actively managing their FIRE portfolios, trading platforms with superior mobile apps, analytics, and zero commissions are beneficial. These platforms make it easier for investors to trade stocks and manage their portfolios with ease.

Some of the best investment apps for hands-on traders include:

Robinhood – This pioneering free trading app offers an engaging, game-like experience. However, limited retirement account options and lack of fractional shares make Robinhood better for short-term trading than FIRE wealth building.

Webull – Started as a Robinhood competitor, Webull provides an advanced mobile app stacked with charts, analytics, and trading tools. The unlimited free stock and ETF trades make high-volume trading affordable.

TD Ameritrade – Is a full-featured platform great for options and margin trading. The trading mobile app provides a robust toolkit for active traders. Retirement and cash management accounts are available.

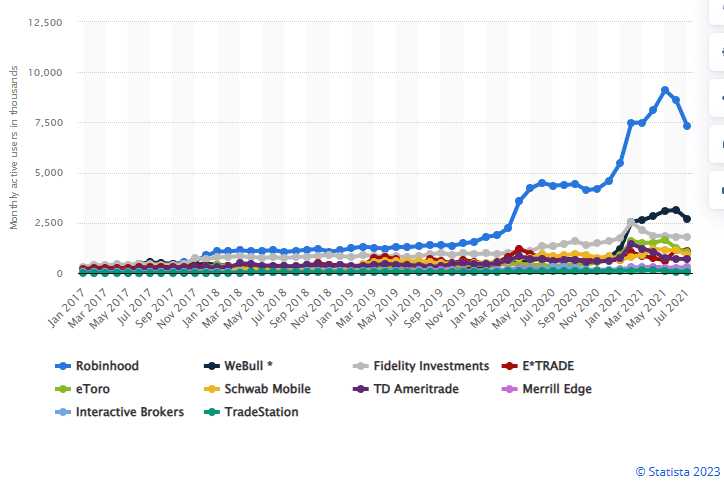

Based on the data by Statistica, as of July 2021, Robinhood was by far the most popular e-trading app in the world, with over 7.3 million users. This was more than double the number of users of second-placed Webull. Moreover, user numbers spiked in early 2021, reaching a peak of over 9 million in May 20211.

Furthermore, a report from February 2021 mentioned that TD Ameritrade had nearly 370,000 downloads in a month (cnbc.com)

Best Robo-Advisors for Automated Investing

Robo-advisors provide algorithm-driven portfolio management using ETFs and index funds. Just answer questions about your goals and risk tolerance. The robo-advisor handles the rest, from asset allocation to rebalancing.

Betterment – One of the first robo-advisors, Betterment offers goal-based portfolio guidance and tax coordination starting at 0.25% annually. Sync external accounts for a complete financial picture.

Wealthfront – Top-notch tax-loss harvesting and cash management services alongside solid robo-advisor capabilities. It is ideal for hands-off investors on the FIRE path.

Ellevest – Ellevest’s robo-advisor caters specifically to women’s retirement planning needs through gender-aware algorithms. Low account minimums.

M1 Finance – This platform is for DIY investors who want automated portfolio rebalancing and dividend reinvesting. It lets you customize your portfolio with stocks and ETFs.

Choosing an exemplary investment service is essential for building wealth on the fast track. Prioritizing low fees, strong returns, and smart automation can help investors achieve their goals. With the right platforms powering their investments from an early age, investors can align their portfolios with their dreams of pursuing a life of freedom and fulfillment through FIRE.

Best Investment Services for Young FIRE Savers

Investment platforms are also tailored to the unique needs of younger savers aiming for early retirement. These platforms provide guidance and services to grow wealth from an early career stage and help investors achieve their financial goals.

Wealthsimple, for instance, manages portfolios, retirement savings, and taxable investment accounts and offers socially responsible investing options. The platform also provides free financial planning sessions with advisors to help young investors make informed investment decisions.

SoFi Invest is another platform that allows young investors to start investing with any amount into ETFs and stocks. SoFi membership also provides career coaching and financial planning guidance, which benefits investors just beginning their careers.

Steady is a tech platform that aims to provide income stability for its users. The platform helps people earn more through its free app, which allows users to build and track income, thereby increasing their overall financial health. Steady connects people with opportunities to make a side income. The app offers many earning opportunities, enabling users to earn money from grants, job listings, and app recommendations with cash sign-up bonuses. On average, Steady app members can earn an extra $5500 annually.

Acorns is another investment platform that allows young investors to invest their “spare change” into ETF portfolios starting with just $1. This platform is ideal for developing smart saving and investing habits from an early age.

In summary, younger savers aiming for early retirement need investment platforms that are tailored to their unique needs. These platforms provide guidance and services to help them grow their wealth from an early career stage and achieve their financial goals. By choosing the right investment platform, young investors can set themselves up for financial success and achieve their early retirement dreams.

Choose the Right Investment Platform for Your FIRE Path

Finding an exemplary investment service is crucial to achieving financial independence and retiring early. Every investor has unique strategies, skills, and styles and must discover the investment platform that best fits their needs. Prioritizing low fees, strong returns, and intelligent automation is essential to building a strong and profitable portfolio.

Furthermore, starting early with the right investment platform can help investors align their portfolios with their dreams of pursuing a life of freedom and fulfillment through FIRE. Whether managing a portfolio for hands-on traders, using robo-advisors for automated investing, or using investment services for young FIRE savers, every investor has a platform.

In conclusion, the journey to financial independence and retiring early requires careful consideration of investment platforms. By prioritizing low fees, strong returns, smart automation, finding the right platform, and having a long-term mindset, investors can achieve their financial goals and pursue a life of freedom and fulfillment through FIRE.